Sous le casque, la cagoule moto n’est pas qu’un accessoire : elle se révèle être l’alliée incontournable du motard. Protection améliorée face aux caprices de

Comprendre les différents types d’assurances auto est essentiel pour trouver la formule idéale. De l’assurance au tiers à l’assurance tous risques, chaque formule offre des

Vous êtes prêt à déménager ou avez besoin d’un véhicule pour transporter du matériel volumineux ? La location d’un utilitaire est souvent la solution idéale.

Lorsque vous conduisez une voiture, vous serez amenés à constater des voyants sur le tableau de bord. Il faut donc savoir ce qu’il y a

Lorsque votre véhicule atteint la fin de sa vie utile, devient une épave ou nécessite des réparations coûteuses, il est temps de prendre des décisions

Le filtre à carburant empêche les particules et les autres saletés d’entrer dans le moteur. Il permet aussi de rejeter l’eau issue de la condensation

La sonorisation de voiture est l’installation d’un système audio de haute qualité dans un véhicule. Généralement, peu importe le prix du produit, un pack ou

Les trottinettes électriques ont rapidement conquis le marché avec leur combinaison unique de performances, de design novateur et de prix attractifs. Celles de la marque

Depuis des années, plusieurs marques de voitures sortent mais parmi elles, certaines sont plus fiables que d’autres. Ces voitures sont aujourd’hui les plus préférées par

Dans l’univers de l’automobile à deux roues, le scooter Aprilia se démarque des autres motos par sa robustesse, ses performances assez séduisantes et son accessibilité

En tant que propriétaire d’une trottinette électrique, il est impératif de souscrire à une assurance de responsabilité civile adaptée. Ces engins, classifiés comme Engins de

Vous recherchez pour vous et votre véhicule une assurance bien couvrante pour vos sinistres et à la fois bon côté rapport qualité/prix ? C’est possible avec

Le choix d’un véhicule pour les sorties du quotidien implique plusieurs facteurs à garder à l’esprit. Le concessionnaire et la marque sont deux aspects essentiels

La voiture de sport est un des véhicules les plus prisés au monde si on ne parle que de sa légèreté et de son design.

Le monde est souvent complexe et imprévisible, et assurer la sécurité de vos foyers est vital. Le feu est une menace importante qui peut mettre

La vanne EGR d’une voiture est un dispositif essentiel pour lutter contre les particules de gaz toxiques produites par les véhicules diesel. En plus du

Vous avez souscrit une assurance auto il y a plusieurs années et vous souhaiteriez peut-être revoir votre contrat. Cela est particulièrement vrai si votre situation

Lors de l’achat d’une voiture Aixam, vous devez réfléchir à l’assurance automobile dont vous avez besoin pour couvrir les risques liés à l’utilisation du véhicule.

Vous aspirez à une conduite silencieuse et confortable ? Vous rêvez de vous glisser dans une voiture qui vous coupe du monde extérieur, où seul

Certaines personnes utilisent leur voiture pour se rendre au travail, d’autres préfèrent le vélo. Mais pour certains d’entre vous, la moto est le choix ultime

Lorsqu’il est question d’acheter un nouveau véhicule, la question de la consommation de carburant est souvent un point prépondérant. La voiture idéale serait celle qui

Vous êtes prêts pour une balade sur votre moto mais vous vous retrouvez confrontés à un problème de démarrage ? Rien de plus frustrant. Ne

En France, le secteur de transport privé est l’une des activités les plus dynamiques de la branche automobile. Destinés aux transports privés, les chauffeurs VTC

Lorsque l’on parle de l’intérieur d’un camping-car, le niveau de confort a considérablement progressé entre les anciens et les nouveaux modèles de véhicules de loisirs.

Les fourgonnettes sont non seulement un moyen de transport précieux pour votre entreprise, mais vous pouvez également en posséder une pour votre usage personnel. Oui,

La liberté de la route à deux roues est un rêve pour beaucoup, mais obtenir son permis moto nécessite une préparation minutieuse. De la formation

Le système d’échappement d’une voiture est une pièce essentielle pour son bon fonctionnement, et il comprend de nombreux composants, dont le flexible d’échappement. Ce composant,

Face à des anomalies, plusieurs personnes ont tendance à se transformer en mécaniciens et commencent par intervenir sur leur propre voiture. Bien que cette solution

Pour circuler librement sur le territoire français et dans la sous-région, tout propriétaire d’une voiture doit avoir sa carte grise. Pour l’obtenir, il faut faire

Comme son nom l’indique, une voiture ancienne peut montrer des signes de vétusté. Elle ne possède pas non plus les dernières technologies sur le marché.

Les personnes atteintes de mobilité réduite éprouvent des difficultés dans leurs mouvements et leurs déplacements. Opter pour un scooter électrique à 4 roues représente l’ultime

Le choix d’un scooter peut être crucial lorsque l’on souhaite se déplacer efficacement en milieu urbain. Parmi les différentes options disponibles sur le marché, le

Le scooter Piaggio Liberty 125 est le choix parfait pour tous ceux qui recherchent un mode de transport efficace, écologique et abordable. Avec son moteur

Le théâtre est une pratique artistique utilisée comme outil de développement personnel. Elle favorise l’épanouissement et l’émancipation de l’individu grâce à des jeux de rôles.

Lorsque l’espace devient insuffisant dans une maison, de nombreuses personnes envisagent une extension pour créer de nouveaux espaces de vie. Cependant, l’une des préoccupations principales

La Croissance Organique en SEO est devenue un sujet incontournable pour les entreprises et les entrepreneurs qui cherchent à se hisser au sommet des résultats

Visiter Calcutta, ville emplie de couleurs et d’histoire. Une fenêtre ouverte sur l’Inde ancienne qui s’ouvre à tous les voyageurs avides de découvrir une culture

Nous sommes tous à la recherche du sourire parfait et d’une bonne santé bucco-dentaire. Mais comment pouvons-nous savoir quelles techniques de blanchiment des dents sont

Aujourd’hui, la gestion de projet est souvent entravée par des obstacles qui peuvent être réduits, voire éliminés, grâce à l’utilisation de pratiques agiles. Agile offre

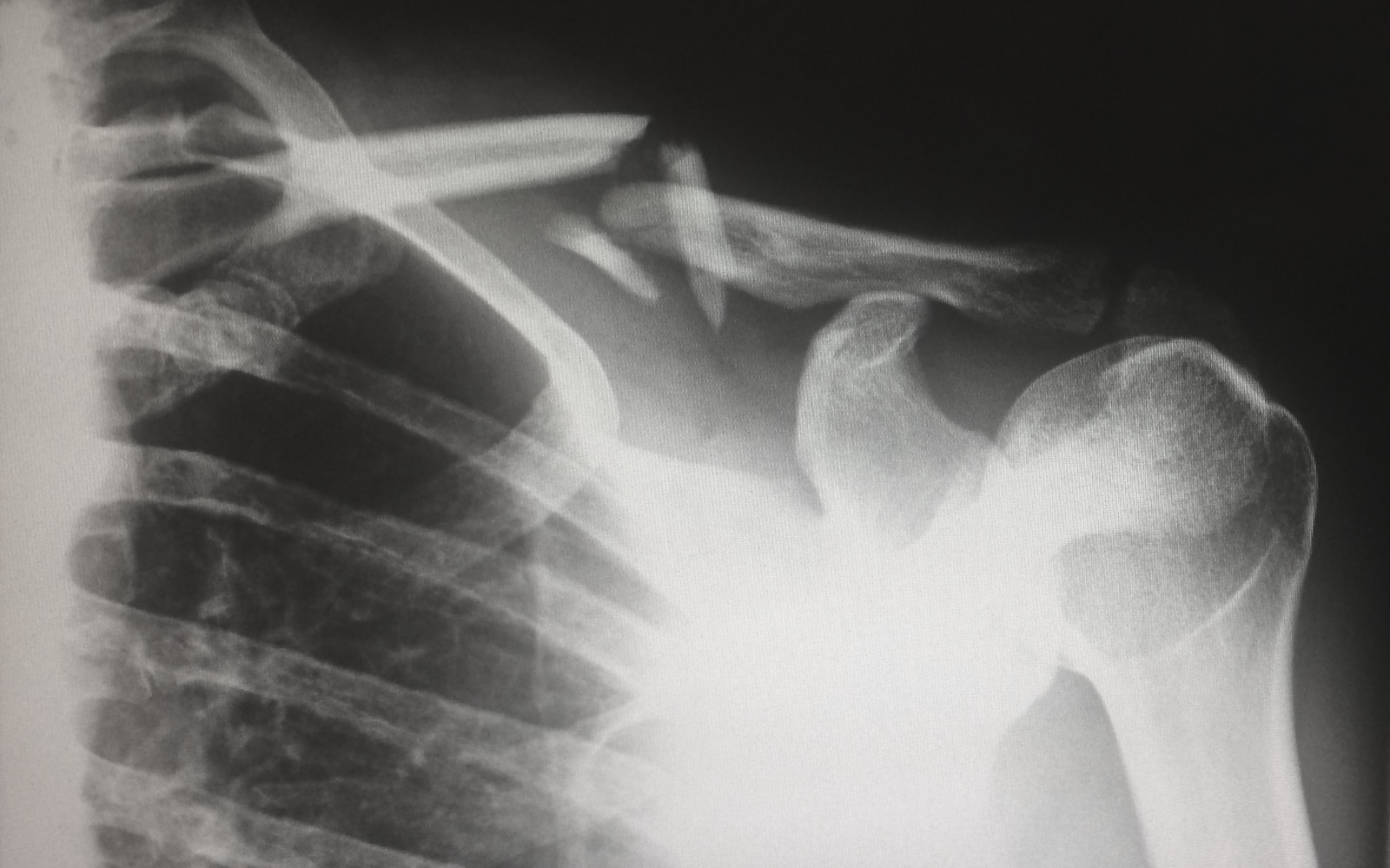

Qu’elles soient le résultat d’accidents, de chutes ou encore d’un mouvement brusque, les fractures osseuses peuvent toucher tous les âges et tout type de personne.

La Bulgarie est un trésor caché à visiter en Europe. Que vous soyez à la recherche de paysages magnifiques, d’une culture riche ou simplement prêt

Une famille nombreuse peut être un joyeux mélange de rires et de sourires, mais cela peut également représenter une organisation et des conditions difficiles à

Saviez-vous que la Maladie de Lyme est l’une des infections bactériennes les plus répandues dans le monde ? Une piqûre de tique peut transmettre cette

Embarquez pour un voyage aux Samoa Américaines, un archipel situé entre Hawaii et la Nouvelle-Zélande. Émerveillez-vous devant des paysages à couper le souffle, explorez les

Êtes-vous prêt à faire de votre site web un atout pour votre entreprise ? Si oui, la création d’un site performant est essentielle. Une bonne

Le navigateur Safari est un navigateur spécialement pour les utilisateurs d’Apple, mais proposé par Google. Que ce soit sur un téléphone ou sur un ordinateur,

Le corps a besoin de toutes les calories qu’il peut obtenir lors du développement de la masse. Vous devez passer par cette étape afin de